Xbox Game Pass smart TV app could help — or destroy — PlayStation

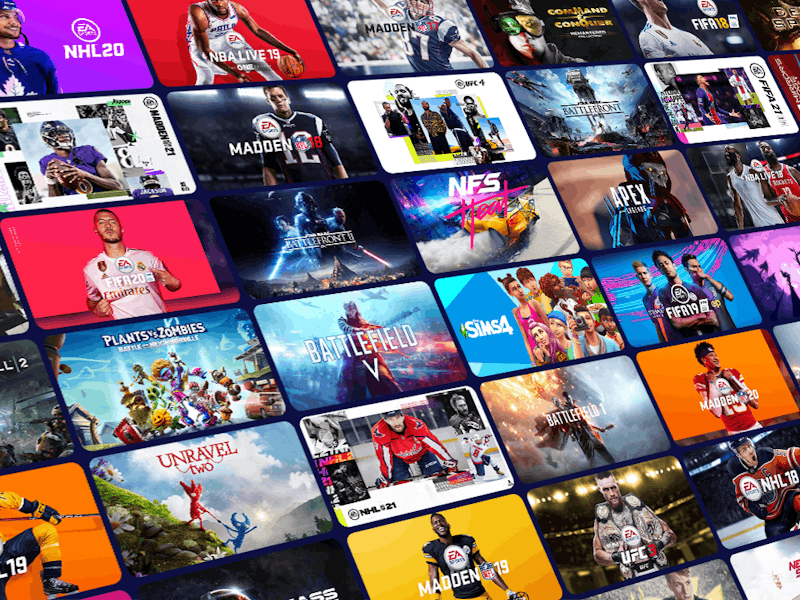

Microsoft’s push to bring Game Pass everywhere could be a huge industry shakeup.

In an early-morning announcement Thursday, Microsoft doubled down on its commitment to its Game Pass subscription service in tandem with its growing xCloud cloud gaming initiative. Should all negotiations go the hardware maker’s way, gamers will soon be able to stream current-gen Game Pass titles across all TVs or screens with internet access or an HDMI port without the need for a console.

Simply put, Microsoft believes its mission to bring Game Pass everywhere will soon be accomplished. At face value, it might seem like this would be bad news for Sony PlayStation consoles, the direct competition. But ultimately, such a shakeup could be mutually beneficial.

In a video accompanying the announcement, Microsoft CEO Satya Nadella stressed that his company’s strong investment in cloud services and its unprecedented amount of resources will allow Xbox to carve out a new corner of the games industry that’s free of the limitations of traditional hardware.

But first: What are your favorite games and platforms of 2021, and what future releases are you most excited about? Take our poll!

Microsoft sees a future in which Game Pass can be enjoyed any way and anywhere.

But what exactly does this news mean for Microsoft’s very traditional gaming competitors at Sony Corp?

As both companies prepare to go toe-to-toe in the summer months with their own respective holiday lineup reveals, is a fully realized Game Pass something that should scare the current undisputed market leaders at PlayStation? From our perspective, Microsoft’s Game Pass plans could be very bad or surprisingly good news for Jim Ryan and the company he leads.

The bad: Sony appears behind and can be financially outmuscled

While Microsoft continues to make waves with its estimated 25 million Game Pass subscribers playing more games and spending more money within those games than ever, the subscription and streaming service quickly overtook PlayStation Now’s 3.2 million subs reported in March of this year.

Even though Sony entered the streaming and subscription market long before Xbox with its acquisition of Gaikai in 2012 and the launch of PlayStation Now in 2014, PlayStation is in a situation where it’s already far behind the competition to a degree that seems insurmountable. There are rumblings across the industry that Sony might be working on some sort of attempted Game Pass killer, but, if that’s true, it must launch and fortify that service soon if it intends to stand a fighting chance against its more powerful foe.

Can Microsoft really push the likes of God of War out of the games industry?

Despite the showboating, Nadella’s points regarding Microsoft’s strength in cloud investment and finances are precisely right.

On the services end, Microsoft owns the sophisticated Azure server farm that’s generally considered to be a top-two cloud service provider alongside Amazon Web Services. In fact, this technology is so well-made that Sony even began exploring a strategic partnership with its rivals to leverage Azure for its own cloud content-streaming services in 2019. In effect, there’s a distinct possibility Sony’s supposed Game Pass alternative could be inadvertently lining Microsoft’s pockets by leveraging Azure backend tech. On the list of prominent cloud providers, Gaikai is almost nonexistent.

The prospect of potentially offering money to your competitors through licensing seems all the more troublesome when that competitor is Microsoft. The company currently has a market cap of around $1.9 trillion, which is chump change compared to Sony’s market cap of $145 billion.

These numbers make it clear that Microsoft has deep pockets. The company can be that much more agile when it comes to lining up partnerships, deals, and other assets designed to make Game Pass an even greater value to consumers. We’ve seen those knock-on effects already with the $7.5 billion acquisition of Bethesda last year, with Xbox’s main goal there being an increase in the size and overall quality of its Game Pass lineup. While it will assuredly take some time to chip away at Sony’s impressive market share, a Microsoft that’s fully invested in gaming in the right ways can push PlayStation out of certain niche areas, especially if streaming is the industry’s future.

The good: Sony’s blue ocean

Regardless of Microsoft’s current perceived edge in the cloud gaming space, however, there are still scenarios by which Sony succeeds by not getting involved at all.

Given the company’s longstanding reluctance to accept modern gaming luxuries like backward compatibility and crossplay, alongside the insistence that consumers spend $69 for its blockbuster exclusives, PlayStation has established a reputation as a legacy gaming brand that may not have to push toward services to remain profitable.

If Sony can wait out Microsoft, it can own its own market just like the Switch.

As Microsoft continues differentiating from Sony with its focus on Xbox Game Pass — seemingly above all else — the opportunity for PlayStation to offer gamers a simpler, more familiar alternative grows.

Consumers have been paying lump sums for games since the dawn of the console market, and the public seems content with that status quo. Building off the success of prestige franchises like The Last of Us, God of War, and Spider-Man, Sony has sold nearly twice the amount of PlayStation 5s compared to Xbox Series X|S consoles. If marketed properly, Sony can position itself as a company that provides premium blockbuster games for a premium price on what looks and feels like a luxury console.

If Microsoft migrates totally away from the console space and into services alone, Sony would easily dominate — particularly because Nintendo has already found a way to remove itself from the console wars. Nintendo knows this tactic well as the so-called “blue ocean” strategy. In the same way Nintendo outlasted all competitors in the handheld console market to resounding success with the Switch, PlayStation might be able to continue to sell physical hardware and individually purchased games in perpetuity. The faster Microsoft distances itself from traditional consoles, the better it might be for PlayStation.

As it stands, Microsoft and Sony are in direct competition, but the more Xbox differentiates from PlayStation, the more likely it is that both companies thrive in lanes that are more distinguished.

This article was originally published on