Did Taylor Swift Predict the Stock Market Collapse?

An economist explains why we should have known what was coming when we heard "Shake It Off."

The stock market took a tumble Monday with most sensible people attributing the downturn, at least in part, to a Chinese stock detonation. The financial talking heads wanted to know where the China watchers were on this one, but maybe they would have been just as justified to wonder where the pop radio listeners were at. According to New York University Polytechnic School of Engineering Finance and Risk Engineering Professor Philip Maymin, Top 100 music has a strong correlation with market volatility.

Maymin made headlines back in 2012 when he published a study in The North American Journal of Economics and Finance claiming a relationship between our iTunes purchases (those innocent pre-Spotify days!) and the markets. Specifically, he documented that less complex songs would be ubiquitous prior to more volatile markets. Maymin was listening to the frantic coverage today and reconsidering his old hypothesis.

“I haven’t re-analyzed recent music for a couple of years now so I don’t know if it was predicted by simpler music,” Maymin told Inverse. “Of course it’s not a 100 percent relationship anyway, but, yes, based on my research I would have expected popular music to have become simpler about a year or so ago, given the huge recent increases in market volatility and complexity.”

Complexity, per Maymin and measured via the Echo Nest algorithm, is the change in variance of a song’s speed; that is, does the beat change? “It doesn’t matter if it’s a fast or slow song,” says Maymin, only that the beat changes.

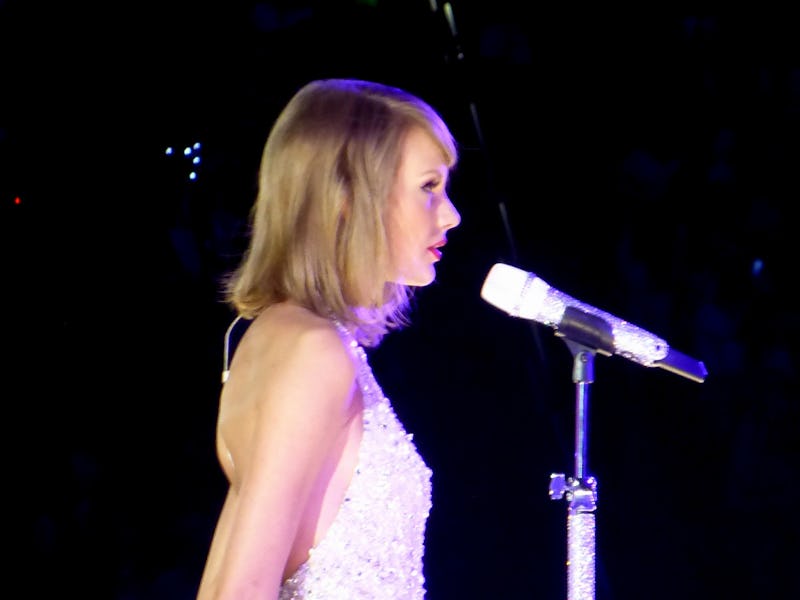

This time last year, Taylor Swift’s earworm “Shake It Off” was taking over the airwaves. Is the song simple? Extremely. “Shake It Off” has very few rhythmic changes. It has 160 beats per minute for most of its length and 75 beats per minute for one portion. It’s a foot tapper because you can tap your feet to it very easily.

Unfortunately, there’s no causation, so we can’t use TSwift’s anthems to try to stabilize the stock market. Instead, what Maymin says drives the relationship are the actors making decisions — that is, us. Maymin believes that if we’re not looking ahead for big changes in the future, good or bad, we have more cognitive reserves for more complex entertainment.

“If I’m planning something complex for the future,” he says, “I’ll tend to prefer something simpler.”

That seems at once counterintuitive and like a just-so story. Although statistical confidence is a powerful tool, it isn’t the end-all of scientific fact. (See: FiveThirtyEight’s great recent feature on statistical relationships or the “theory” that a lack of pirates means a warmer globe.)

But Maymin, by way of analogy, explains there’s a reason why we would see less complex music prior to volatile markets. If you’re driving down the highway in the middle of Kansas — the stable, less risky scenario — you can handle a little tempo shift, because staring at those corn stalks sure ain’t gonna cut it. If you’re parallel parking in Manhattan, you poor soul, you’re not going to want to focus on music that demands your attention.

Could today’s Billboard Top 100 predict the next volatile market? Are we gearing for a wave or riding a flat current? We’ll have to wait and see to find out. Maymin doesn’t know Fetty Wap from OMI.