The Search Is on for (Cheap) Nuclear Fusion

Can a handful of startups win the race to market nuclear fusion -- at a fraction of the cost of government-funded projects?

Tri Alpha Energy, a Southern California fusion startup, just raised nearly $500 million to try to make fusion power a reality. Funded by heavyweights like Goldman Sachs and Paul Allen, the company thinks it might have a prototype reactor ready at some point in the 2020s.

Fusion is as elusive as it is expensive. CERN’s Large Hadron Collider is famous for its work as a high-energy particle accelerator, but fusion as a practical, commercially viable form of energy is still tantalizingly out of reach. Magnetic confinement fusion is advancing but still beyond us. Cold fusion is regarded as a bogeyman and a joke by the majority of the scientific community, though it maintains a faithful core of supporters.

An ambitious class of startups, though, is attempting various lower-budget reactor designs in an effort to make fusion — and with it, the potential for limitless clean energy — a reality. And an affordable one, at that.

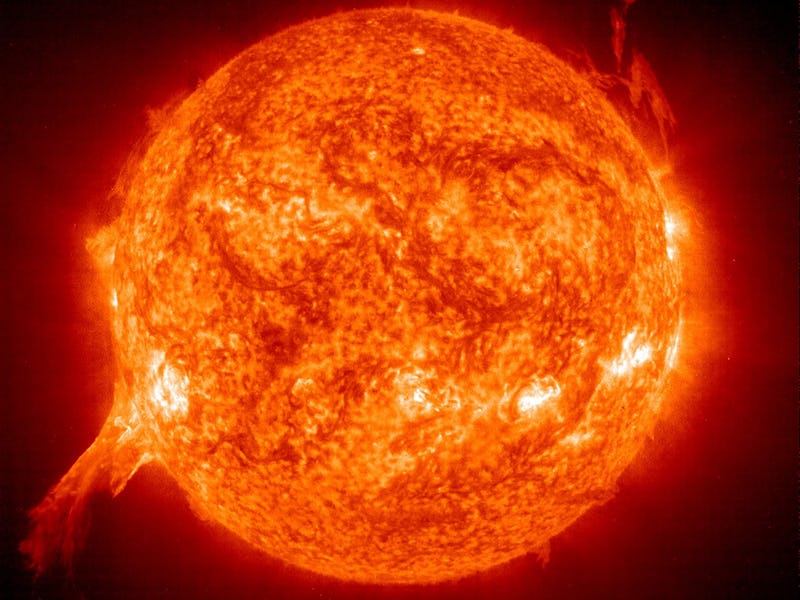

As the MIT Technology Review reported in its sneak peak of the company, Tri Alpha Energy already claims to have kept high-energy plasma stable in its “locomotive-size” generator for a full 11.5 milliseconds, which relatively speaking, is a long time.

Founded in 2002, this Vancouver-based startup says it’s planning a full-scale net gain prototype system that emphasizes low cost and practical results. “The prototype will be designed for single pulse testing, demonstrating full net energy gain on each pulse, a world first.” It’s not clear exactly when that will happen, but the company seems to be on a similar track to Tri Alpha, expecting results of some sort within a decade. General Fusion is a major player in the race for cheap (relatively, anyway) fusion; it has 10 major investors, including Bezos Expeditions (yes, that Bezos. Dude has his hand in literally everything).

Helion is based in Redmond, Washington and is doing its thing with $5 million from the Department of Energy. It also lists Mithril and Capricorn Investment Group as partners. It’s pursuing magneto-inertial fusion, and claims that by “combining the stability of steady magnetic fusion and the heating of pulsed inertial fusion, a commercially practical system has been realized that is smaller and lower cost than existing programs.” The company says it plans to market its designs commercially by 2022.

Okay, “startup” doesn’t really do justice to the massive, international collaborative research project that is ITER. This is here for context. The project is French, but it’s supported by literally dozens of countries, including the United States. They’re collaborating to build the largest-ever tokamak, or magnetic fusion device. ITER claims it will be the first to produce net energy and maintain fusion for an extended period of time.

Originally pitched as a (again, relatively) somewhat quick and cheap route, ITER’s own timeline has already been pushed back (as is common for all things fusion-related) by at least six years, and the budget hiked from around $6 billion to nearly $20 billion. You now see why fusion startups are a thing.